C.09 Compliance - Objectives

- Jun 22, 2018

- 2 min read

Updated: Feb 17, 2024

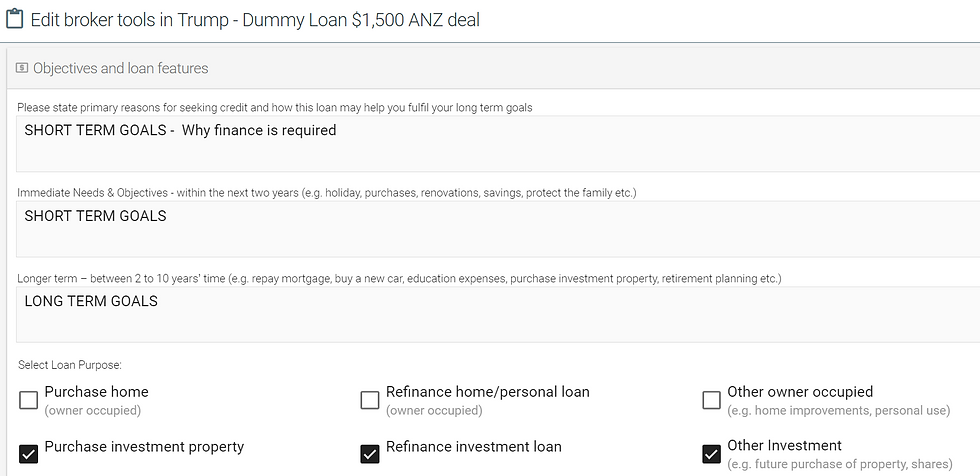

Fact Find - Objectives (ie Loan Purpose)

Premium Brokers compliance requires Brokers to make reasonable enquiries into a clients wants and needs from a loan. These objectives need to be declared and noted within VowNet on the Objectives. Categories to be noted include

Objectives

Loan Purpose

Loan Features

Desired Loan Splits

Preferred and Non-Preferred Lenders

Financial Security

SHORT TERM GOALS - Why finance is required?

Maybe the most important field to get right!

This field needs to be the most comprehensive field as it captures what the client really wants. It should be more than 3 sentences long and is in important part of the SOCA & Compliance documents.

It should include the amount they want to borrow, the location, the type of transaction and details of the loan and what they want out of a loan.

NOTE: A client may complete this field as part of there access to the Client Portal.

For example they may enter via the client portal

LOAN PURPOSE "We want a house to live in"

This is not acceptable

This fields becomes part of your SOCA document so YOU NEED TO CHANGE IT.

This needs to be YOUR ACCOUNT of what the client wants for example:

LOAN PURPOSE

Donald and Melania are looking to borrow $1,390,800 to assist with the purchase of an owner occupied house.

The proposed security will be a $1,500,000 property located at 549 Willoughby Road, Willoughby

They are looking for a lender who is good with a limited deposit and savings.

They want a lender who does not assess business debt and prefer a loan with offset, redraw & internet banking.

Of all these the most important requirement was a cheap rate and low LMI.

We have therefore considered the lenders we are accredited with, who would meet the clients requirements.

We have therefore recommended the following loan/s

$1,390,800 AMP Banking 6.50% Personal Home Loan - Principal & Interest - Variable

Best Practice & Key Risk Indicators

Numerous industry committees have recommended increased broker governance, specific to capturing a clients Requirements and Objectives (R&O). It is important to lenders and auditors that we capture detailed information about a clients R&O to avoid poor customer outcomes. This field is therefore highly monitored by audits and aggregators as a Key Risk Indicator alike.

*Key Risk Indicators - would act as triggers/flags for potential poor customer outcomes.